The biggest promise of cryptocurrency to the world is the opening up of lucrative income avenues and accessibility of payments universally irrespective of the geographical boundaries thanks to the emergence of decentralized finance or DeFi. The concept of DeFi lies at the forefront of innovation in the world of crypto and blockchain. The revolutionary financial concept has already gained a lot of traction and it is likely to gain more success in the years ahead as cryptocurrencies gain more steam. DeFi is a decentralized and permissionless system offering a variety of benefits for those in the financial services segment but users need a safe and secure DeFi wallet. The DeFi Protocol requires users to have a DeFi wallet which would also guarantee the security of their crypto assets and coins with the provision of upgraded security and complete control of cryptos.

Crypto enthusiasts and financial players can tap in new revenue streams and can also take advantage of accessing every segment of the financial services – be it loans, insurance, savings and also trading just with a single tap on their smartphones with the DeFi. However, they also need to begin focusing on the development of their own DeFi wallets to thrive well in the new financial world. The most important step is to understand how the DeFi wallets work – the salient features of these wallets, their advantages over the traditional wallets and financial systems and also uncover the steps needed for the development process of the DeFi.

However, before you rush into the setting up of the DeFi wallets, let’s get a basic understanding of the DeFi wallet.

Overview of Defi Wallet

DeFi wallet is critical for the smooth and proficient functioning of users within the DeFi conventions. All the users need a protected, impregnable wallet where the client’s crypto resources are stored safely with just a few features such as the public and private keys that are indestructible with security breaks. A safe DeFi wallet is the most important thing when applying for loans, trading tokens, improving liquidity, and so on. Moreover, given the fact that DeFi is a free, open, permissionless framework that isn’t upheld by the government, it becomes all the more necessary to have a secure DeFi wallet where the crypto assets are free of security breaches and risks.

With Defi wallets, you could have your own financial and banking systems, where there is complete transparency, accessibility, freedom, and also security. The users would have control over their funds and this is the reason why these wallets are getting popular in the crypto space.

DeFi wallets indispensable part of the DeFi ecosystem

It is for the sustenance of the entire DeFi ecosystem that it is necessary to have the DeFi wallets. Defi wallets are the ultimate asset management tool for businesses necessary to back the DeFi biological system. In a centralized system, users are required to rely on traditional financial bodies such as banks or custodial wallets for holding their cryptos or digital assets. But the major problem with these custodial wallets or intermediaries is that they were not free of security risks. Being non-custodial in nature, the DeFi wallets also allow users the chance, ease, and also convenience of performing the financial functions, thus pushing further the idea of “being their own bank”. Custody of funds in the case of DeFi wallets are not in the hands of third parties, thus rendering complete freedom, facilitating transparency, and also providing accessibility to the users.

With Defi wallets, clients can perform a variety of activities – right from buying or selling tokens to token trades, Dapp communication, financing, loans and exchange, and so on. The introduction of DeFi wallets is a progressive step given that the banks so far have been the sole entities to deal with the individual’s funds entirely for ages.

Practically all the DeFi wallets are built on the most popular blockchain – Ethereum and hence they uphold the ETH, ERC – 20 tokens, and also the ERC- 721 tokens. The Defi Wallets also supports and acknowledges the other DeFi tokens as most of them will be run on Ethereum.

DeFi wallets are attractive to users given that here the individual identity is never cast without a doubt. These are the safest possible choice conceivable to store and hold digital assets. Moreover, users are not needed to provide too much of their personal and background information, thus ensuring that the personal identity of individuals is never threatened. However, clients using DeFi wallets should know that recovery of DeFi wallet once the login data is lost can prove to be risky.

Comparison between DeFi Crypto wallet and Traditional wallets

Decentralized finance lets users remain the main custodian of their funds – something which is not possible with centralized financial systems such as banks and financial authorities. These traditional financial institutions vest limited power in the hands of clients. Here are the key points of differences between the DeFi wallet and traditional crypto wallets

DeFi Wallet

- It entrusts the user with custody of their funds thus pushing forth the concept of “ be your own bank”

- Private keys enable users to have access to their digital assets

- Setting up a DeFi wallet requires minimal personal information from the clients to help them make their best use

- DeFi wallets can be easily integrated with all other DeFi platforms

- Practically all assets and currencies are supported by it

Traditional Crypto Wallets

- Only the centralized authorities are placed with absolute trust to handle the funds

- It is only with the asset owners that lies the private key

- KYC is compulsory for all users

- It may or may not be possible to integrate the centralized systems with the DeFi platforms

- All asset-based and cryptocurrencies may or may not find any support

The way how Decentralized Crypto Wallet work

Crypto holders must set up DeFi crypto wallets if they wish to hold their digital assets in the safest way possible. Given that there is no single point of failure with such DeFi wallets, it is the perfect place to hold cryptos. DeFi Wallet infrastructure is hosted on millions of nodes and hence it is immutable and tamper-proof since it is not possible for hackers and cyber fraudsters to alter or misuse any of the nodes. Thus it remains well-protected from fraudulent activities and also provides easy accessibility to funds to users from both online as well as offline sources. Security is never compromised even in case the device is hacked. DeFi with its decentralized nature lets users integrate with other web3 wallets and manage their assets across major platforms from one point. Thus users will not have to leave their wallet app and they can manage their diverse crypto-assets all from one place.

Core components of a DeFi Crypto Wallet

While building a DeFi wallet, ensure that you first study the core characteristics and keys of these wallets and explore the ones that you would want to execute in your DeFi development platform. Whether the features that you implement with your product rely on popularity over other traditional wallets and remains a favorite with users relies heavily upon the functionality and ease of use of your application. However, understand the key features that you can integrate into your wallet:

Ø Non-custodial in nature: DeFi wallet users can enjoy complete ownership over their digital assets as they do not render the third-party custodians with any control or ownership for funds of users

Ø Holding crypto assets in one place: The DeFi wallets are based on smart contracts and hence they can hold all crypto assets and also DApps tokens. Hence, it is easy for crypto users to utilize them without setting up multiple accounts for different exchanges. Users can access all their digitally stored assets with their own private keys.

Ø No need for separate wallet integration: DeFi wallets ensure that the wallets can be integrated with other platforms and there is a smooth token swapping service for customers thanks to the in-built features

Ø Key-based secured transactions: Users of the DeFi wallet users can initiate and also process transactions with the help of unique private key

Ø Easy compatibility: It is easy to integrate the DeFi wallets with web3 wallets and users can access the Dapps – all from their mobiles only.

Ø Secure and immune to breaches: DeFi wallets are not vulnerable to data thefts and cyber security risks thus providing enhanced security and control to users over their funds.

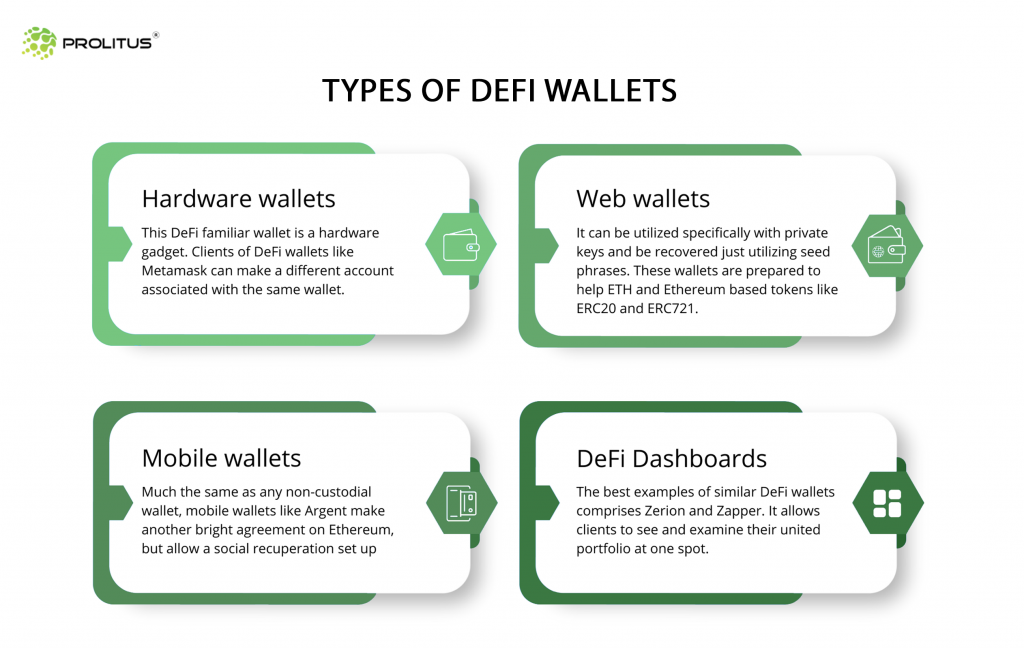

Types of DeFi wallets:

- Web Wallets

- Hardware Wallet

- Mobile Wallets

- DeFi Dashboards

Web wallets: These wallets can be used with private keys and it can be recovered using seed phrases. E.g. – Metmask is the main example of DeFi wallets that provides users with an entry to different DeFi applications and can also support both ETH and ERC -20 and ERC-721 tokens. However only when the user misplaces the private key that problems arise with such DeFi wallets.

Hardware wallets: This kind of DeFi wallet can be found in a hardware device where the users can store huge amounts of assets in these wallets and the private keys ensure security against hackers. A major additional advantage of these wallets is that users of DeFi wallets such as Metamask can set up a separate account related to the same wallet.

Mobile wallets: It is the same as any form of non-custodial wallet since users are the sole custodians of their funds. It is built with a new smart contract on Ethereum providing control to users. Argent is a major example of a mobile wallet that also allows a social recovery setup where trusted associates or also “Guardians” and outsiders can encourage starting social recovery. There is the choice available to users in mobile wallets to freeze their wallets whenever they need to do so and also set gradually transfer limits.

Defi dashboards: Users of the DeFi dashboards are provided with the choice to see and analyze their combined collection all at the same from a single spot. Other wallets can get connected to this dashboard and financial transactions can be initiated.

Development of DeFi wallets by hiring the services of proficient blockchain developers can turn out to be quite a favorable decision for businesses to get better returns. Launch your own DeFi wallet with our proficient blockchain developers. Enhanced security combined with decentralization facilitates users with absolute proprietorship over their digital assets.

Best DeFi wallets

Some of the popular DeFi wallets are as follows:

MetaMask: Users using this DeFi wallet can access this through any internet-connected device. It can perform several roles across applications and industries thanks to its plugin system, which is why it is truly handy! The wallet offers wide support across the greater DeFi ecosystem, ENS compatibility, wallet-readiness for mobile devices and also faster transactions.

Coinbase Wallet: The way people buy and store cryptocurrencies can also be transformed with the help of this wallet. Users of this wallet don’t need to manage their own funds and cryptos can also be secured safely. Interaction with decentralized applications also becomes easy with this service. Coinbase wallet allows users to keep public keys for transactions. The biggest advantage of this wallet is the seamless transfer facilitated between apps and on and off-ramps facilitated by the platform provided by users.

Argent: It facilitates free transactions and has simple addresses in place with no paper backups. Crypto accessibility is one big feature of this wallet and it renders without compromising on the functionality and also the design features so as to create better user experience. The prime purpose of this is to let users take advantage of the decentralization of the web. Users can enjoy a great mobile-DeFi experience as it renders the integration of a number of renowned products for users. There is no transaction fee and users do not need to store ETH for making financial transactions.

The process to set up your wallet and use it

Step 1- Locate the problem and set objectives

At the initial stages, lookout for ways in which the DeFi wallet can solve a specific problem and if the blockchain technology could solve it. Hiring a good business analyst can be really helpful.

Step 2- Designing the Architecture

Pick up the framework where you can position your DeFi wallet- whether in-house, in a hybrid manner, or in the cloud. Post the framework, you could pick a perfect accessibility solution – be it private, permissionless, public or hybrid. However, having a private blockchain can prove to be quite effective for your decentralized wallet.

Step 3- Picking up the Consensus Algorithm

Decide on the type of network members need for the purpose of authentication of their transactions. It is best to take the advice of a proficient developer and a business analyst to know the process of transaction authentication method – be it via proof of work or proof of stake.

Step 4- Choose the Platform

Finally, select the blockchain platform on the basis of stability, requirements, and also budget for developing the DeFi wallet. Ethereum is the hot favorite platform for developing the DeFi wallet. Given that it is now an open-source platform, development costs are also less and speedier.

Future of the Defi Wallet and how it can transform lives

The entire DeFi ecosystem’s success is determined by the DeFi wallets. These wallets let users manage their digital assets and carry out seamless transactions even with other DeFi apps. Decentralized wallets serve as a better alternative to conventional banking systems. DeFi is the future and DeFi wallets are likely to replace the existing centralized system.

Prolitus DeFi wallet development services

Exploring different ways to launch and develop a DeFi wallet, Prolitus can help. Our expert team will render support to get you to ride this new wave with the most powerful DeFi wallet development services. Contact us and start today! DeFi wallet users can manage their assets and track their funds without the need of a third party owing to the secured and robust feature-rich wallets. Private keys will also help users to keep and manage their assets in the wallet safely.