LedgerScore Case Study

Case Study

A Project Overview

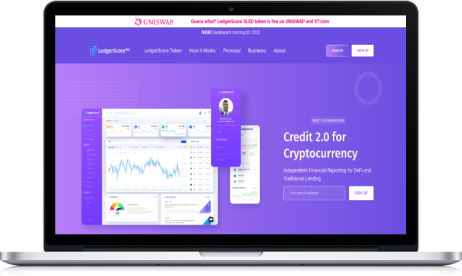

Building LedgerScore aimed to offer crypto users to keep track of their crypto income, crypto assets, and crypto payments and not be part of the isolated, anonymous crypto world where it's difficult to track credit scores based on the activities.

The lenders can further verify this information so that users can easily apply for loans against their crypto earnings along with the collateral.

visit website

Challenges

- The biggest challenge is to build a credit-scoring platform for crypto users. Mostly the crypto transactions happen on non custodial and custodial wallets. Finding the right approach to track trading activities was quite important.

- Considering a lot of crypto assets available on different exchanges, we needed to shortlist some of the assets that would be verified on the platform in one place.

- Another Challenge was the Integration with the Centralized Exchange APIs. These exchanges have a different Authentication mechanism, hence integrating it with the Ledgerscore platform was not an easy task. We had to work on the oAuth and APIs.

- Based on the portfolio, we wanted to issue users a secured credit card and installment loan. Finding the right strategies and doing all the legal work was a task.

Solutions

Intelligence Platform based on Financial Factors and Parameters

We leveraged some of the financial aspects of offering the loans and conducted financial research to lock in the right parameters to help decide the User's eligibility for the loan or the credit card.

Intuitive and Simple to Use UI/UX

Built an easy-to-use User Interface and User experience that caters to the needs of non-tech-savvy people. We ensured that our platform did not have complex or difficult-to-navigate features.

DevOps and Cloud Computing toolings.

For storing and processing data, we used DevOps and Cloud Computing tooling. We ensured that the latency time for the queries was minimal, so users did not have to wait much without compromising on security.

Intensive Technical Research and Architecture design

We gathered all the important information based on the Proof of Concept we initially built and made multiple iterations to ensure that the end-to-end product is secure and feature-rich.

Result

- After following the correct strategies, we built fully-fledged software that keeps track of the health of the crypto User’s Account.

- With the help of Ghost ID and passwordless login, users could easily access the platform without worrying much about the Auth2.0 login or signing up for the platform.

- Further, we also integrated a news feed to ensure that all the users on the platforms have complete access to the news from the world and do not miss any updates. As the crypto market is quite volatile, it was quite important to integrate this feature.

- Getting an Additional Wallet Address, registering the claims, and doing 3rd Party KYC were some of the primary features developed for the software.

- We Integrated some features that help to keep track of the Market caps of tokens like USDT, BTC, and ETH. Also, we allowed users to track LED tokens and USDT prices for everyday trading.

Conclusion

Implementing a crypto credit score was quite a great problem statement to solve. As it revolves around financial aspects and crypto-economics, it was also a great learning experience for the team.

Also, Users now do not need to visit multiple platforms as Ledgerscore is architected so that our developers have ensured that all the users' crypto assets are tracked at one place.

Using the Ledgescore platform, users can now easily open an account and make monthly payments to build great credit scores.

contact

us

Have a Project in mind?

Let’s make it happen