Real-world Assets Development: Shaping the future of digital asset management with tokenization

Asset tokenization stands as the harbinger of a new era in investment, democratizing ownership in the world of high-value assets such as art, real estate, and government treasuries. Take, for instance, the art world's transformation, where Andy Warhol's iconic "Rebel Without a Cause" can be owned for a mere $200, thanks to tokenization. Yet, this concept is not limited to art; it extends to bonds, automobiles, precious metals, and more, captivating the interest of traditional financial institutions.

Real-world asset tokenization leverages blockchain technology to create virtual investment vehicles linked to tangible assets, eradicating intermediaries like lawyers and brokers, leading to significant cost reductions. Furthermore, it paves the way for 24/7 trading, enhancing liquidity and transparency. Imagine owning a share of an artwork alongside numerous others, trading independently without the need for cumbersome galleries or banks.

Asset tokenization isn't restricted to high-value items; it spans across the U.S. Treasuries, currency, and stocks, offering efficient fractional ownership and expeditious settlement times. As the tokenized asset market gains momentum, industry experts anticipate it to burgeon into a colossal $16 trillion market by 2030, presenting unprecedented growth prospects.

To embark on this lucrative journey, you need to engage with an Asset Tokenization Platform Development Company like us. We can guide you through the intricate process of creating tokenization platforms, ensuring access for investors of all scales to previously untapped markets. You can explore our Tokenization Platform Development services and build the platform you envision for trading real-world assets in tokenized form.

Our Asset Backed Tokenization Services

Unlock the potential of Asset Backed Tokenization with our expert services. Digitize real-world assets securely for increased liquidity and accessibility.

Real Estate Tokenization

Tokenize real estate assets to let investors access and purchase them across the globe.

Commodity Tokenization

Tokenize your art pieces and 10x your capabilities to scale your business strategy and needs.

Document Tokenization

Unlock the opportunity to tokenize venture capital funds and get access to better fundraising opportunities.

Utility Assets Tokenization

Easily convert illiquid assets into tokens, increase their trading margins, and convert them into cash without any loss in value.

Metal Assets Tokenization

Back your tokens with precious metals like gold, silver, and collectible cars to get more investors on board.

Security Tokens

Explore the world of commodities by tokenizing assets of renewable energy.

RWA Ecosystem

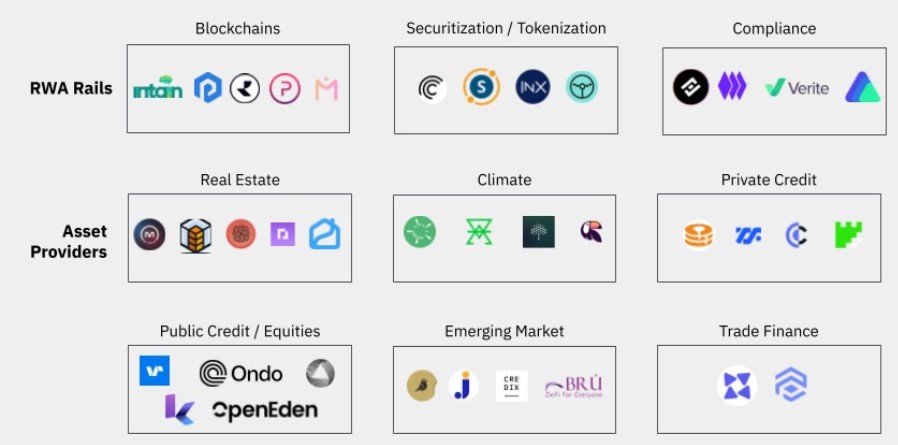

The real-world asset (RWA) ecosystem is growing steadily, with new projects continuously entering the market. Some of these projects establish the necessary regulatory, technical, and operational infrastructure for RWAs to enter the cryptocurrency space, often referred to as "RWA rails." In addition to this, there are "asset providers" that specialize in originating and generating demand for RWAs across a wide range of asset classes, such as real estate, fixed income, equities, and more

- Private Credit: Originate and create demand for private fixed-income-backed RWAs.

- Public Credit / Equities: Originate and create demand for public fixed-income and equity-backed RWAs.

- Emerging Market: Originate and create demand for RWAs coming from emerging markets.

- Trade Finance: Originate and create demand for trade financially-backed RWAs.

- Blockchains: Permissioned and permissionless blockchains tailored specifically for RWAs.

- Securitization / Tokenization: Bringing RWAs onto the blockchain.

- Compliance: Services to ensure investor and issuer compliance.

- Real Estate: Originate and create demand for real estate-backed RWAs.

- Climate: Originate and create demand for climate asset-backed RWAs.

Our Asset Tokenization Development Process

Discover our Asset Tokenization Development Process, a streamlined approach that digitizes tangible assets, ensuring security and accessibility.

Token Modeling

Choose the appropriate token model for representing assets based on various token standards.

Asset Modelling

Outline the level of trust required for data, business processes, and scope involved in the digital asset tokenization service.

Review

Thoroughly review the technology and security aspects of the informatic code during our tokenization platform development services.

Deployment

Conclude our asset tokenization services by deploying the informatic code onto the distributed ledger technology or blockchain.

Why Chose Prolitus for Assets Tokenization Platform?

Prolitus excels in tokenization platform development, offering top-notch solutions with a proven track record, expertise, innovation, and a client-centric approach.

Tech Proficiency

Tech Proficiency

Our team consists of highly skilled blockchain developers with hands-on experience in Substrate development. We have a proven track record of delivering successful blockchain projects.

Tailored Solutions

Tailored Solutions

We understand that every project is unique. We take the time to understand your requirements and provide customized solutions that align with your business goals.

Quality Assurance

Quality Assurance

We follow industry best practices and rigorous testing methodologies to ensure that our solutions are secure, reliable, and scalable.

Client-Centric Approach

Client-Centric Approach

Your satisfaction is our top priority. We maintain open communication throughout the development process, providing regular updates and incorporating your feedback.

24/7 Technical Support

24/7 Technical Support

We provide round-the-clock technical assistance to address any issues or queries promptly, ensuring uninterrupted operation and peace of mind for our clients.

FAQ

contact

us

Have a Project in mind?

Let’s make it happen